Global “all-weather” portfolios - investment adventures of an Aussie couple

15 Aug 2019In this blog we share our path to applying US-centric All-Weather investment information to an Australian situation, with the result being a global All-Weather portfolio. This is by no means advice, rather we share our experience in case it is interesting or useful to others and to further develop our ideas. We embarked on this because our current situation necessitated reducing our investment timing risk and an “All-Weather” approach could smooth out the ride.

Our story - discovering “All-Weather” investment & why we wanted in

We (Amy and Dan) are a couple in our early 30s, just married, and enjoying the flexibility of renting without a house mortgage. Until 2018 we invested almost 100% of our (modest) savings in a portfolio of equities (aka. shares/stocks) - following advice given to people with long time-horizons to invest savings heavily in equities, preferably by dollar cost averaging, to maximize returns over the long run. We were happy to take on the risk of equities until we decided we might want to buy a house in the next 5 years and realized our equity investment time-horizon wasn’t so long-term after all.

We knew from the stock market’s history that our life-savings could quickly plummet in value and take years to recuperate. We didn’t want this to happen at the same time we planned to use our savings for a house deposit! So we started selling our equities and by the start of 2019 most of our savings were sitting in a cash savings account.

The problem was that it could be awhile before we actually purchased a house and we had a nagging sense that our savings should be doing more for us in the meantime. We no longer want the risk of being almost 100% in equities but we also aren’t happy holding mainly cash since any other asset class will provide more returns than cash over time. And we definitely weren’t interested in trying to time the equity market. So what to do?

When we heard about Bridgewater Associates’ “All-Weather” strategy to minimize downturns in any economic environment while outperforming cash this seemed like an elegant solution. Living in Melbourne with its reputation for four seasons in one day we’ve learnt to either be prepared for surprise changes in weather or face the consequences! [queue Four Seasons In One Day by Aussie band Crowded House]. The “All-Weather” analogy struck a chord and we thought having an investment portfolio designed to weather any economic storm would be awesome for our situation!

Image source.

Image source.

The next question was how? There is no way we could afford the hedge fund giant’s minimum buy-in for their All-Weather fund, and the fund is closed to new investors anyway, so this was not an option. We looked around but couldn’t find anyone offering a suitable All-Weather style fund that we could access. So we decided to build one ourselves.

Fortunately, in 2014 the founder of Bridgewater Associates, Ray Dalio, shared his recommended asset types and weights for a very simplified version of All-Weather that an average person could implement themselves, in an interview with life/business strategist Tony Robbins. This helped us to get a sense of what our portfolio might look like. But because the advice was targeted at US citizens, we weren’t sure if it was directly applicable to us (as Australians) or how to practically implement it.

Our problem - how do we apply US-centric All-Weather advice to our Australian situation?

We found several blogs/articles about how a normal US citizen could implement their own All-Weather-like strategy but it was not clear how to do this in Australia. So we set out to find a solution that we could personally use, which we share in this blog.

But first, a brief background on what is an All-Weather portfolio?

What is an All-Weather portfolio?

“If you can’t predict the future with much certainty and you don’t know which particular economic conditions will unfold, then it seems reasonable to hold a mix of assets that can perform well across all different types of economic environments. Leverage helps make the impact of the asset classes similar.” (from Bridgewater’s The All-Weather Story)

All-Weather is an approach to asset allocation designed to minimize downside and perform relatively well regardless of the prevailing economic environment, hence the name “All-Weather”. The concept was first implemented by Ray Dalio and his team at Bridgewater Associates, now the largest hedge fund in the world. In researching and developing All-Weather, Bridgewater recognized there are primarily two factors driving the value of any asset class - the levels of economic activity (growth) and inflation. Therefore, the economy can be broadly viewed as having four “environments”. These are:

(1) Rising growth; (2) Falling growth; (3) Rising inflation; and (4) Falling inflation.

Throughout history and across countries, distinct asset classes have consistently performed well during each of these four environments. So, there is a season for all assets, but unlike the real weather we never know which seasons are next or when the seasons will change, and worse, two seasons can occur at once! So surprises impact asset prices due to unexpected rises or falls in growth and inflation.

Recognizing this, an All-Weather portfolio essentially comprises four sub-portfolios - one for each economic environment containing assets known to perform well in that environment. Asset weights are then balanced to achieve risk-parity between each of the four environments. Bridgewater’s diagram below shows the four economic environments containing examples of relevant asset types, with risk divided equally across environments.

Image taken from Bridgewater’s The All Weather Story

Image taken from Bridgewater’s The All Weather Story

The All-Weather approach assumes we can’t forecast the future so we don’t know which particular growth/inflation conditions will unfold. Given this, it assigns weights such that there is an equal amount of risk (25%) in each of the 4 possible growth/inflation environments. Therefore the portfolio is designed to perform no matter which growth/inflation environment eventuates.

All-Seasons portfolio

As mentioned above, Tony Robbins popularised a simplified version of Dalio’s All-Weather, coined the “All-Seasons” portfolio in his 2014 book MONEY Master the Game: 7 Simple Steps to Financial Freedom. Robbin’s has also published a free version of the Ray Dalio All-Weather interview in this Yahoo Finance article which is worth a read.

In a nutshell, the Dalio/Robbins All-Seasons portfolio looks like this:

- 30% stocks

- 40% US long-term treasury bonds (20-25 years)

- 15% US intermediate-term treasury bonds (7-10 years)

- 7.5% gold

- 7.5% commodities

All-Seasons vs Bridewater’s All-Weather - what’s the difference?

An important point to clarify is that All-Seasons is NOT the same as Bridgewater’s All-Weather. Bridgewater uses cheap leverage and sophisticated investment instruments to increase returns while still minimizing risk. The simplified All-Seasons portfolio does not use leverage and thus has lower expected returns than Bridgewater’s All-Weather, but still reduces risk.

Throughout this article, we use the term “All-Weather” to convey the general concept of diversified, risk-balanced asset allocation developed by Bridgewater outlined above, acknowledging that All-Weather portfolios that utilise leverage appropriately, like Bridgewater do, will outperform non-leveraged versions. See the Q and A section below for more commentary on using leverage in a risk balanced investment strategy.

As an aside, we’re still working on figuring out how the average individual investor in Australia can cost-effectively leverage the lower volatility assets (e.g. Treasury bonds) to have similar expected volatility/returns as equities, thus maintaining risk parity while increasing returns, like Bridgewater can. One way might be through Treasury bond futures. But we need to iron out how to achieve this practically in a cost effect way. If you have the answer, let us know!

So, we set out to understand how to create our own All-Weather portfolio(s) without using leverage, for now.

Our solution - domestic and global portfolios

We wanted a globally diversified All-Weather portfolio. We achieved this by creating essentially two sub-portfolios - an All-Weather portfolio containing Australian domestic assets, and another All-Weather portfolio containing global assets for geographic diversification. First, we’ll share how we developed the domestic portfolio. Then we’ll delve into the global portfolios.

Click here to skip straight to our table of portfolios showing individual securities and weights.

Domestic

The All-Seasons portfolio outlined by Robbins’ has a domestic bent, comprising US stocks and government bonds (ie treasuries). We wanted exposure to both Australian and Global asset markets.

The relevant global ETFs available on the Australian Securities Exchange (ASX) exclude Australian assets (ie are “ex AU”). Therefore to have exposure to Australian and global markets it was necessary to include these securities separately (see the Q and A section below for more commentary on this).

We first located domestic Australian securities traded on the ASX matching each asset type suggested by Ray Dalio to Tony Robbins for the simplified All-Seasons portfolio. The Table 1 below includes the relevant Domestic securities we found.

Scroll down to Table 2 and for example portfolios that select one security from each asset type.

Table 1. Relevant securities for asset types in an Australian domestic “All-Seasons” portfolio.

| Asset type | Relevant securities via ASX / unlisted fund |

|---|---|

| Equities | Vanguard Australian Shares Index ETF (VAS); BetaShares Australia 200 ETF (A200); BetaShares Australian Sustainability Leaders ETF (FAIR); Vanguard Index Australian Shares Fund (VAN0010AU) |

| Long-term Australian treasury bonds (~20-25 yrs) |

Long-term exchange-traded treasury bonds (ETBs): - year of maturity - 2037 (GSBG37); - year of maturity - 2039 (GSBK39); - year of maturity - 2041 (GSBI41); - year of maturity - 2047 (GSBE47) |

| Intermediate Australian treasury bonds (5-10 yrs) |

Vanguard Australian Government Bond Index ETF (VGB); BetaShares Australian Government Bond ETF (AGVT); iShares government bond index ETF (IGB) |

| Gold | BetaShares Gold Bullion ETF - Currency Hedged (QAU); ETFS Physical Gold (non-hedged) (GOLD); Perth Mint Gold (PMGOLD) |

| Commodities | BetaShares Commodities Basket ETF - Currency Hedged (synthetic) (QCB) |

We understood that the underlying principles of the All-Weather approach are timeless and universal and therefore would apply in Australia (and globally). But we weren’t sure whether the asset class proportions recommended for the US All-Seasons would be the same in Australia. So we (particularly the data scientist among us) wanted to test it out on plenty of historical data before trusting it with our life savings. To sense test, we first looked at historical performance using the All-Seasons asset weights for both US and Australian assets.

Dan built an algorithm to perform risk-parity weighting in line with Bridgewater’s All-Weather principles. This was useful to:

- confirm that Australian and global based asset classes have roughly the same relative risk-weightings as their US counterparts,

- allow adjustment of the risk-parity weights to account for additional asset types, such as inflation linked (IL) bonds and emerging market (EM) credit, and

- back-test the resulting portfolio weights to assess historical returns and more importantly, drawdowns, in terms of their size, duration and frequency.

Experimenting with different assets through this algorithm gave us comfort that the asset weightings recommended for the US are generally applicable in Australia (and globally). Since Bridgewater uses IL-bonds and EM credit in their All-Weather strategy, and since we can access these via the ASX and have an algorithm enabling us to risk-balance them, we also added IL bonds (and EM credit for global) to our versions of the All-Weather. Historical performance plots in Figure 1, using Australian domestic assets, shows that “our version” does a very good job of avoiding downturns compared to 100% equities/ASX300.

For sure, Figure 1 shows the overall return of 100% equities (ASX 300 accumulation) was the highest, but it also shows one could have put money in/taken it out of All-Seasons and Our Version at any time since 2001 without suffering unpalatable losses. This is what we are currently after! The same can not be said for 100% equities/ASX300 which, on four occasions between 2001 and 2019, suffered drawdowns large enough to be unacceptable for our current situation.

Domestic Australian All-Seasons and Our Versions of the asset mix protect capital, with less frequent and smaller drawdowns than the ASX 300

Figure 1. Historical performance simulations of domestic Australian “All-Seasons” and “Our Version” portfolios show these portfolios had considerably smaller and less frequent drawdowns compared to 100% equities via the ASX 300 acummulation index. The relevant securities and weights for each of these portfolios are shown in Table 2. ETFs for the required asset classes were not available prior to 2012 so the pre-2012 performance shown is based on their underlying indexes. Historical bond performance was derived from futures price indices with coupon payments accumulated semi annually at historical 10 year yield rates. The commodities performance reflects underlying SPGCLEP commodities index only, excluding potential ETF distribution payments. We painstakingly sourced this historic index data from a variety of free sources and can’t guarantee its accuracy - if anybody reading this has access to a proprietary data source they’d like to share with us, please get in touch!

Figure 1. Historical performance simulations of domestic Australian “All-Seasons” and “Our Version” portfolios show these portfolios had considerably smaller and less frequent drawdowns compared to 100% equities via the ASX 300 acummulation index. The relevant securities and weights for each of these portfolios are shown in Table 2. ETFs for the required asset classes were not available prior to 2012 so the pre-2012 performance shown is based on their underlying indexes. Historical bond performance was derived from futures price indices with coupon payments accumulated semi annually at historical 10 year yield rates. The commodities performance reflects underlying SPGCLEP commodities index only, excluding potential ETF distribution payments. We painstakingly sourced this historic index data from a variety of free sources and can’t guarantee its accuracy - if anybody reading this has access to a proprietary data source they’d like to share with us, please get in touch!

Note these simulated results do not include brokerage fees and assumes the desired portfolio balance is maintained throughout, whereas in practice, the portfolio would be rebalanced periodically (e.g. every 6 months or so). Simulated historical performance results have inherent limitations since unlike an actual performance record, simulations do not reflect the cost of trading or the impact of actual trades on market factors such as volume and liquidity. See the Q and A section below for commentary on periodic rebalancing.

Lower risk comes with lower expected returns

We’re not suggesting our simple All-Weather portfolio is optimal or will maximize returns. It almost certainly won’t. Rather, it is designed to protect assets by avoiding large drawdowns during economic upheavals and market downturns, while still providing reasonable returns above the cash interest rate. In our current circumstance the security of knowing we are less exposed to downturns is worth the decreased expected return potential.

Global

A limitation we saw of a domestic Aussie portfolio was a lack of geographical diversity. To get more exposure to global activities and therefore hopefully more resilience to economic surprises, we made a second All-Weather portfolio using global assets. (For more on the benefits of geographical diversification, including for All-Weather, see Bridgewater Associates’ April 2019 memo.)

We used Dan’s algorithm to create All-Weather risk parity weightings for global assets and back-test them. We used historic data from ETFs available on US securities exchanges for this task because they have existed for longer than their Australian ETF counterparts and therefore have more data.

This process meant we identified ETFs available on US securities exchanges that can be used to create a global All-Weather portfolio. We also included US only stocks and government bonds in the mix because the US-exchanged global shares and bond ETFs exclude US stocks and bonds. For completeness we’ve included these securities in Table 2 under columns “Global (NYSE/ NASDAQ)” and “Global with IL-bonds (NYSE/ NASDAQ)”.

Out of curiosity we added inflation-linked bonds to our Global (NYSE/ NASDAQ) portfolio. But given we could not find a global IL bond ETF on the ASX, we chose not to include IL bonds in our Global (ASX) portfolio. Of course it would be possible to access a Global IL bonds ETF via an international trading platform, but at this point we wanted to stick to ASX traded global securities to reduce complexity.

The historical performance plot in Figure 2 below shows that our Global version also does well at avoiding downturns compared to a 100% global equities allocation. Again, 100% equities gives a higher return, but our current time-horizon and needs favour limiting drawdowns over maximising returns.

Our Global asset mix protects capital during turbulence with less frequent and smaller drawdowns, compared to 100% Global Equities

Figure 2. Historical performance simulations of “Our Version” of an unleveraged global All-Weather portfolio show it had lower returns but also considerably smaller and less frequent drawdowns compared to 100% “Global Equities”. The relevant securities and weights for each of the portfolios depicted here are provided in Table 2.

Figure 2. Historical performance simulations of “Our Version” of an unleveraged global All-Weather portfolio show it had lower returns but also considerably smaller and less frequent drawdowns compared to 100% “Global Equities”. The relevant securities and weights for each of the portfolios depicted here are provided in Table 2.

Note these simulated results do not include brokerage fees and assumes the desired portfolio balance is maintained throughout, whereas in practice, the portfolio would be rebalanced periodically (e.g. every 6 months or so). Simulated historical performance results have inherent limitations since unlike an actual performance record, simulations do not reflect the cost of trading or the impact of actual trades on market factors such as volume and liquidity. See the Q and A section below for commentary on periodic rebalancing.

Table 2. Relevant securities and their weights for each of the portfolios represented by the historical performance plots: All-Seasons (Domestic Australia), Our Version including IL Bonds (Domestic Australia), Our Version (Global-ASX), Our Version (Global-US NYSE/NASDAQ), Our Version including IL bonds (Global-US NYSE/NASDAQ). Historical performance simulations of these portfolios versus 100% equities are shown in Figure 1 and Figure 2. A short description for each ticker is provided in Table 3 below.

| Asset type | All Seasons Domestic Aus (ASX) | Our Version Domestic Aus (ASX) | Our Version Global (ASX) | Our Version Global (NYSE/ NASDAQ) | Global with IL-bonds (NYSE/ NASDAQ) |

|---|---|---|---|---|---|

| Equities | 30% VAS or FAIR | 24% VAS or FAIR | 20% VESG; 3% VGE |

10% VEA; 11% VTI; 3% EEM |

9% VEA; 11% VTI; 2% EEM |

| Emerging market credit | - | - | 13% IHEB | 12% EMB | 10% EMB |

| Long-term treasury bonds (~20-25 yrs) | 40% GSBK39 &/or GSBI41 &/or GSBE47* | 25% GSBK39 &/or GSBI41 &/or GSBE47* | - | 27% TLT | 19% TLT |

| Intermediate treasury bonds (~7-10 yrs) | 15% IGB | 15% IGB | 51% VIF | 22% BWX | 23% BWX |

| Inflation linked bonds | - | 24% ILB | - | - | 10% TIP; 5% WIP |

| Gold | 7.5% PMGOLD | 6% PMGOLD | 7% GOLD | 8% GLD | 6% GLD |

| Commodities | 7.5% QCB | 6% QCB | 6% QCB | 7% DBC | 5% DBC |

Note on long-term treasuries in Australia:

Of note is that we could not find any ETFs on the ASX that tracked long term (~20-25 years) Australian treasury bonds. We found only individual exchange traded long-term treasury bonds (ETBs). These ETBs have lower liquidity than the ETFs which can make it difficult to buy and sell when desired. Because of this we considered not using long-term bonds at all. But since Dalio recommended including long-term bonds because they provide higher returns than intermediate (due to higher volatility), we decided to give the ETBs a go. Increased bond volatility and returns was particularly important to us since we have not yet figured out how to leverage up the volatility and returns of our bond holdings in a cost effective way.

Table 3. Description and Exchange for each security listed in the Table 2. It’s worth noting that BetaShares Australian Sustainability Leaders ETF (FAIR) provides an ethical/sustainable Aussie equities option, and Vanguard Ethically Conscious International Shares Index ETF (VESG) provides an ethical/sustainable Global equities option, we found these really interesting.

| Ticker | Exchange | Description |

|---|---|---|

| BWX | NYSE | SPDR Barclays International Treasury Bond |

| DBC | NYSE | Invesco DB Commodity Index Tracking Fund |

| EEM | NYSE | iShares MSCI Emerging Markets ETF |

| EMB | NASDAQ | iShares JP Morgan USD Emerging Markets Bond ETF |

| FAIR | ASX | BetaShares Australian Sustainability Leaders ETF |

| GLD | NYSE | SPDR Gold Shares |

| GOLD | ASX | ETFS Physical Gold (non-hedged) |

| GSBE47 | ASX | Exchange-traded Treasury Bond – maturity 2047 |

| GSBG37 | ASX | Exchange-traded Treasury Bond – maturity 2037 |

| GSBI41 | ASX | Exchange-traded Treasury Bond – maturity 2041 |

| GSBK39 | ASX | Exchange-traded Treasury Bond – maturity 2039 |

| IGB | ASX | iShares government bond index ETF |

| ILB | ASX | iShares Government Inflation ETF |

| IHEB | ASX | iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF |

| QAU | ASX | BetaShares Gold Bullion ETF - Currency Hedged |

| QCB | ASX | BetaShares Commodities Basket ETF - Currency Hedged (synthetic) |

| PMGOLD | ASX | Perth Mint Gold ETF |

| TIP | NYSE | iShares TIPS Bond ETF |

| TLT | NASDAQ | iShares 20+ Year Treasury Bond ETF |

| VAS | ASX | Vanguard Australian Shares Index ETF |

| VESG | ASX | Vanguard Ethically Conscious International Shares Index ETF |

| VIF | ASX | Vanguard International Fixed Interest Index ETF (Hedged) |

| VGE | ASX | Vanguard FTSE Emerging Markets Shares ETF |

| VEA | NYSE | Vanguard FTSE Developed Markets ETF |

| VTI | NYSE | Vanguard Total Stock Market ETF |

| WIP | NYSE | SPDR FTSE International Government Inflation-Protected Bond ETF |

Closing Remarks

In the hope it may be interesting or useful to others, we’ve shared our experiences of realising we had to switch our time-horizon from long- to medium-term when thinking about investing, and that an “All-Weather” approach could help us do this. We’ve also shared our path to overcoming the problem of how to apply US-centric All-Seasons/All-Weather advice to an Australian situation using both domestic and global assets - the result being a globally diversified All-Weather portfolio. We do not comment on what percentage should be allocated to domestic vs global assets, however we do discuss this further in the Q and A section.

It’s worth noting that if our personal situation was different, say already owning a house and not needing to draw on our savings for the next 20 years, we may just keep dollar cost averaging our savings into low cost passive equity index funds. But that’s not the case for us right now.

Also, we are not trying to convince anyone in any situation to take our approach. We know a lot of people are interested in All-Weather, and we are simply sharing our own process and experience in building these portfolios in case it is interesting/beneficial to others, and also to clarify and develop our own thinking. To be clear, we are not qualified in finance - our backgrounds are data science/neuroscience, and law/environmental sustainability.

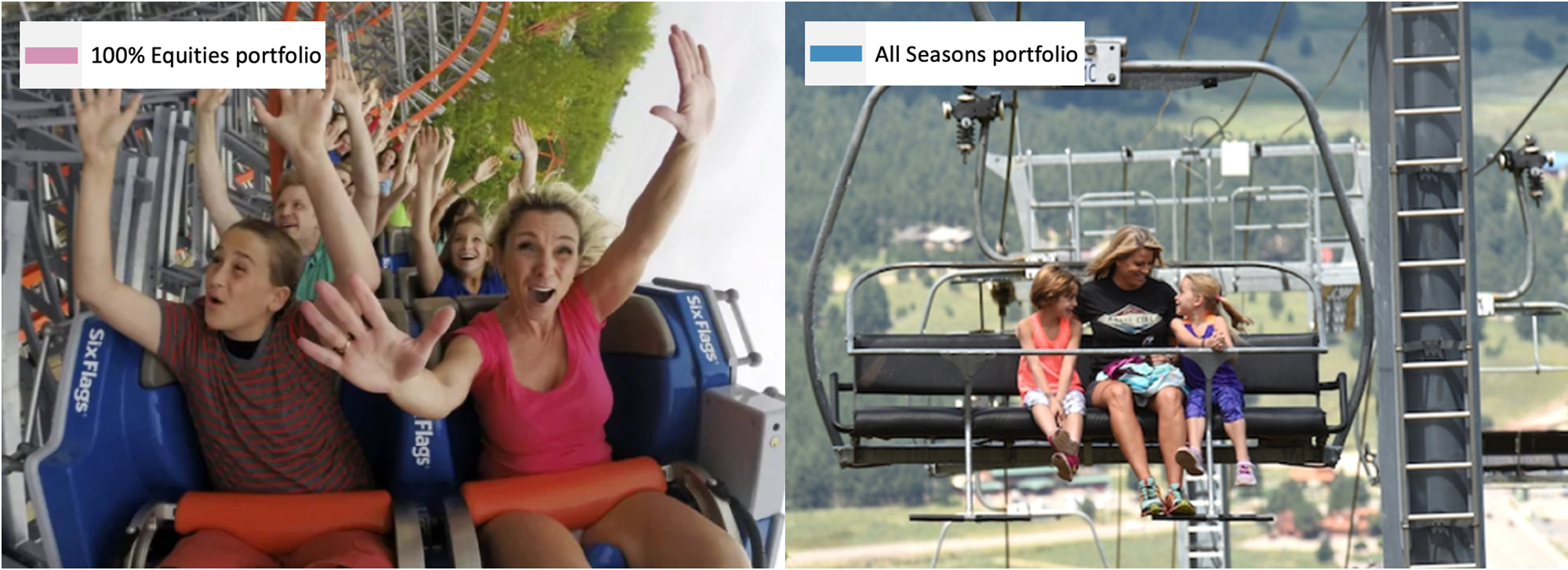

But we’ve enjoyed finding a solution to protect our assets’ value during any economic environment in case we want to draw on it at any time. We hope our approach will tame the rollercoaster that comes with the usual bull-runs and drawdowns when entirely in equities (see Figure 3 below), and also decrease our discomfort if there is another big down-turn like 2008.

We plan to keep refining our All-Weather portfolios / approach as time permits, hopefully finding practical ways to a) leverage the low volatility assets up to the level of equities’ volatility thus maintaining our All-Weather risk balance while increasing our expected returns, b) include global IL bonds in our ASX based global portfolio, c) add more ESG compatible assets, d) improve the code in our all-weather-risk-parity repository to allow it be used for any country (pull-requests with improvements/additions welcome if any devs. are reading this!), and e) research whether or not there is a place for crypto currencies to be added into our All-Weather asset mix. So much to do, so little time! But we’ll see how we go.

Figure 3. For illustration purposes (read for the lulz) only may not reflect reality!

Figure 3. For illustration purposes (read for the lulz) only may not reflect reality!

Questions & Answers

As we were trying to understand Bridgewater’s All-Weather principles, some obvious questions occurred (and were flagged) to us, which are addressed below.

Of course, we cannot comprehensively cover everything here. If you’re after a deeper understanding, we recommend reading Bridgewater Associates’ 2015 article ‘Our thoughts about Risk Parity and All Weather’, which addresses common questions and misconceptions about risk parity and All-Weather.

Question: Is the All-Weather asset allocation based on past correlations between assets, which are unstable/unreliable going forward?

Answer: No, because:

- The asset allocation is not based on the correlations between assets.

- Rather, the portfolio is created based on the relationships of assets types to their environmental drivers. (There are four environmental drivers – economic growth, economic decline, inflation and deflation.)

- While asset classes offer a risk premium that is similar once adjusting for risk, their inherent sensitivities to shifts in the economic environment are different.

- Therefore, we can structure a portfolio of risk adjusted asset classes so that their environmental sensitivities reliably offset one another, leaving the risk premium as the driver of returns.

Question: Wouldn’t leveraging the bonds (or other less volatile assets) increase the risk of the portfolio?

Answer: No, because:

- The leverage makes the volatility of your bonds’ equal to your equities and thus gives better diversification than possible without leverage. “For example, if I put 50% of my money in an unleveraged Treasury bond and 50% of my money in stocks, my portfolio would have been dominated by stocks during the 2008 financial crisis because stocks are more volatile; however, if I leveraged my bonds to have the same volatility as stocks, I would have had much better diversification and would have had much lower risks during the financial crisis.” (Bridgewater’s Engineering Targeted Returns and-Risks)

- We wouldn’t need to use too much leverage, for example Bridgewater’s All-Weather strategy is only around 2 times leveraged.

Question: Is being Australian (earning and spending Australian dollars etcc) a good reason to run an Australian-only portfolio? Given Australia is such a small market compared to the rest of the world, wouldn’t it be better to come up with a currency hedging strategy to overlay across a global portfolio?

Answer: This is an important question in relation to portfolio diversification.

-

A desire to have geographical diversification was the reason we created a global All-Weather portfolio. The reasons for our approach to develop both the domestic and global portfolios separately are two-fold:

- First, it was simpler to apply the All-Weather principles to domestic and global separately because global All-Weather asset allocation is more complex than domestic only. Our limited resources and reliance on global index funds means our global risk weightings are less precise. This is in part because we cannot control the exact weightings the index funds use across countries. For example, the global stocks ETF is geographically weighted differently to the global bonds ETF.

- Second, the global ETFs traded on the ASX exclude Australian assets (ie are “ex AU”), therefore to have exposure to Australian markets it is necessary to include these securities separately.

- Although we have noted that geographical diversification is important (see relevant Bridgewater Associates 2019 article and Vanguard Australia 2017 article on benefits of international diversification), we have not commented on how we think assets should be allocated across the Australian vs Global assets because it is a thorny issue. For example, if we were to allocate assets based on Australia’s market cap within global indices, we would only have about 3% Australian assets and the rest (97%) would be global. However, Vanguard Australia’s research shows that Australians tend to have a strong home bias when investing in shares. In 2014, Australians collectively held 66.5% Australian shares in their share portfolio, despite Australia representing only approximately 2.5% of the global market at that time. Robin Bowerman, Head of Corporate Affairs at Vanguard Australia comments that ‘home-bias investing ranks among the biggest forms of under-diversification’ (see Bowerman’s article). We have found that we are not completely immune to this ‘home bias’, even though we are aware of the problem!

- According to Aidan Geysen, Senior Investment Strategist and Manager with Vanguard’s Investment Strategy Group, there are numerous reasons investors prefer home equities, some of which are behavioural and some that have sound investment rationale, including ‘a preference for the familiar, ease of access, aversion to currency risk, tax benefits and liability hedging to name a few’ (see Geysen’s article). Along with all information included in our article, we leave the reader to form their own view on what geographical asset allocation is most appropriate.

Question: How does your algorithm arrive at the target weights for the various asset classes?

Answer: The algorithm takes as input the users’ desired assets which the user has already pre-assigned into their relevant “environments” in this ‘portfolio-settings.yaml’ file (e.g. stocks go in the ‘rising growth’ and the ‘falling inflation’ environments because that’s when they tend to do well, IL-bonds assigned to the ‘rising inflation’ and ‘falling growth’ environments, etc). The algorithm then:

- creates weights for risk-parity of the assets within each environment, essentially creating 4 “sub-portfolios”, a sub-portfolio for each environment. Then,

- it looks at the overall volatility of each sub-portfolio and creates risk-parity weights between each of the 4 sub-portfolios so each takes on 25% of the risk. Then,

- each asset’s final weight is determined by the sum of [its within environment weights]-multiplied by-[its overall environment weights], and the final ticker weight is output. The within- and between-environment risk-parity calculations are performed with the help of a python version of Ze Vinicius and Daniel Palomar’s ‘riskParityPortfolio’ package.

Question: How do you know when and by how much to rebalance the portfolio weights. Is this based on the prevailing growth and inflation environments? If so wouldn’t it require a measure and also a forecast for growth and inflation?

Answer:

- This passive All-Weather approach assumes we can’t/won’t forecast the future so we don’t know which particular growth/inflation conditions will unfold. Given this, it assigns weights such that there is an equal amount of risk (25%) in each of the 4 possible growth/inflation environments. Therefore the portfolio is designed to perform no matter which growth/inflation environment dominates.

- Regarding the question of when/how much to rebalance: how much is easy because we simply rebalance so our portfolio weights are back in line with the target weights already determined by the All-Weather risk-parity algorithm. These target weights shouldn’t change much year-to-year as they should be arrived at using many year’s historical volatility data. Each additional year of volatility data has small effect on overall volatility estimates.

- But when to rebalance depends on how happy we are to let the weights drift considering brokerage costs. In this article on a simplified version of Ray Dalio’s All-Weather, Robbins recommends rebalancing the All-Seasons “at least annually” and notes that “if done properly, this can actually increase tax efficiency”. People’s tax situations vary so we don’t comment on a tax strategy here.

- If a big financial upheaval, like in 2008, occurs in the middle of our usual rebalancing interim, it may be worth rebalancing prematurely. But assuming our portfolio weights are still within a few % of the targets weights (we’d assign some arbitrary threshold, say <10% abs. overall unbalance) there should be limited need to rebalance outside our chosen interval.

Question: What about including crypto currencies like BitCoin?

Answer: We could certainly consider adding crypto currencies like BitCoin into an asset mix, if we had good reasoning and evidence to decide in which of the four environments it should do well. But we have not yet done any research to confirm. We plan to research this in the future.

Want to know more about Bridgewater’s All-Weather investment strategy? See their articles: