All-Weather Portfolio Update

12 Apr 2020How has our all-weather strategy held up so far in the COVID-19 epidemic?

An Update

A number of people have asked how our investment strategy - outlined in our August 2019 blog post called Global “all-weather” portfolios - investment adventures of an Aussie couple - has fared in response to the Covid-19 epidemic.

The August 2019 blog shared our research into a strategy designed to perform relatively well in any economic environment. We are very glad that we did this research and took action based on our findings. It has served us well in these turbulent times!

Rather than replying to each person individually, Amy and I decided we’d do 2 things: 1) I’d write this update adding the latest data to the performance plots described in our original blog post, to show how that has fared during the time since we first published it; and 2) Amy would write a quick post showing our evolved solution executing an Environmental, Social, and Governance (ESG) filtered version of this strategy as a single ESG portfolio diversified across global geographies and risk balanced across asset classes.

But below are the updated versions of the plots from our original blog post - with new data added to cover the 8 months since we published it:

Domestic Australian assets - performance updates:

The original domestic Australian asset mix since we published it in Aug 2019

The domestic Australian “All-Seasons” and “Our Version” portfolios have had superior returns and smaller drawdowns compared to 100% equities via the ASX 300 accumulation index, since we published the asset mix in Aug 2019. The relevant securities and weights for each of these portfolios are shown in Table 2 of our original blog post.

The domestic Australian “All-Seasons” and “Our Version” portfolios have had superior returns and smaller drawdowns compared to 100% equities via the ASX 300 accumulation index, since we published the asset mix in Aug 2019. The relevant securities and weights for each of these portfolios are shown in Table 2 of our original blog post.

Historical performance of the original domestic Australian asset mix

Historical performance simulations of domestic Australian “All-Seasons” and “Our Version” portfolios show these portfolios had considerably smaller and less frequent drawdowns compared to 100% equities via the ASX 300 accumulation index. Although the overall return of 100% equities (ASX 300) was the highest, one could have put money in/taken it out of All-Seasons and Our Version at any time since 2001 without suffering unpalatable losses. The same cannot be said for the ASX 300 which, on five occasions since 2001 has suffered drawdowns large enough to be unacceptable for our situation. The relevant securities and weights for each of these portfolios are shown in Table 2 of our original blog post. ETFs for the required asset classes were not available prior to 2012 so the performance shown is based on their underlying indexes. Historical bond performance was derived from futures price indices with coupon payments accumulated semi annually at historical 10 year yield rates. The commodities performance reflects underlying SPGCLEP commodities index only, excluding potential ETF distribution payments and currency hedging effects. We painstakingly sourced this historic index data from a variety of free sources and can’t guarantee its accuracy - if anybody reading this has access to a proprietary data source they’d like to share with us, please get in touch!

Historical performance simulations of domestic Australian “All-Seasons” and “Our Version” portfolios show these portfolios had considerably smaller and less frequent drawdowns compared to 100% equities via the ASX 300 accumulation index. Although the overall return of 100% equities (ASX 300) was the highest, one could have put money in/taken it out of All-Seasons and Our Version at any time since 2001 without suffering unpalatable losses. The same cannot be said for the ASX 300 which, on five occasions since 2001 has suffered drawdowns large enough to be unacceptable for our situation. The relevant securities and weights for each of these portfolios are shown in Table 2 of our original blog post. ETFs for the required asset classes were not available prior to 2012 so the performance shown is based on their underlying indexes. Historical bond performance was derived from futures price indices with coupon payments accumulated semi annually at historical 10 year yield rates. The commodities performance reflects underlying SPGCLEP commodities index only, excluding potential ETF distribution payments and currency hedging effects. We painstakingly sourced this historic index data from a variety of free sources and can’t guarantee its accuracy - if anybody reading this has access to a proprietary data source they’d like to share with us, please get in touch!

Note these simulated results do not include brokerage fees and assumes the desired portfolio balance is maintained throughout, whereas in practice the portfolio would be rebalanced periodically. Simulated historical performance results have inherent limitations since unlike an actual performance record, simulations do not reflect the cost of trading or the impact of actual trades on market factors such as volume and liquidity.

Foreign Assets - performance updates:

The original foreign asset mix since we published it in Aug 2019

Our Versions of the unleveraged foreign asset mix have had superior returns and also smaller and less frequent drawdowns compared to 100% “Global Equities”. The relevant securities and weights for each of the portfolios depicted here are provided in Table 2 of our original blog post.

Our Versions of the unleveraged foreign asset mix have had superior returns and also smaller and less frequent drawdowns compared to 100% “Global Equities”. The relevant securities and weights for each of the portfolios depicted here are provided in Table 2 of our original blog post.

Historical performance of the original foreign asset mix

Historical performance simulations of “Our Version” of an unleveraged global All-Weather portfolio show it had lower overall returns but also considerably smaller and less frequent drawdowns compared to 100% “Global Equities”. Although 100% global equities gave a higher overall return over a longer period, our time-horizon and needs currently favour limiting drawdowns over maximising returns. The relevant securities and weights for each of the portfolios depicted here are provided in Table 2 of our original blog post.

Historical performance simulations of “Our Version” of an unleveraged global All-Weather portfolio show it had lower overall returns but also considerably smaller and less frequent drawdowns compared to 100% “Global Equities”. Although 100% global equities gave a higher overall return over a longer period, our time-horizon and needs currently favour limiting drawdowns over maximising returns. The relevant securities and weights for each of the portfolios depicted here are provided in Table 2 of our original blog post.

Note these simulated results do not include brokerage fees and assumes the desired portfolio balance is maintained throughout, whereas in practice, the portfolio would be rebalanced periodically. Simulated historical performance results have inherent limitations since unlike an actual performance record, simulations do not reflect the cost of trading or the impact of actual trades on market factors such as volume and liquidity.

An important point to reiterate is that the portfolios here are NOT the same as Bridgewater’s All-Weather. Bridgewater uses cheap leverage and sophisticated investment instruments to increase returns while still minimizing risk. These simplified portfolios we show here do not use leverage and thus have lower expected returns than Bridgewater’s All-Weather, but still reduces risk compared to 100% equities.

Our continued evolution

We wanted a single globally diversified portfolio filtered for ESG/ethical considerations and based upon the principles discussed here and in our original blog post…

So now Amy and I can share our evolved solution, executing an ESG filtered version of this strategy!

Looking forward, we’re still making good progress on figuring out how to cost-effectively leverage our lower volatility asset classes (e.g. the Treasury bonds) to have similar expected volatility/returns as equities, thus maintaining risk parity while increasing returns, like Bridgewater can. We are still ironing out more details around margin requirements, transaction costs, rebalancing, etc. and codifying our strategy into software, but it is looking very promising. So stay tuned for the future instalments!

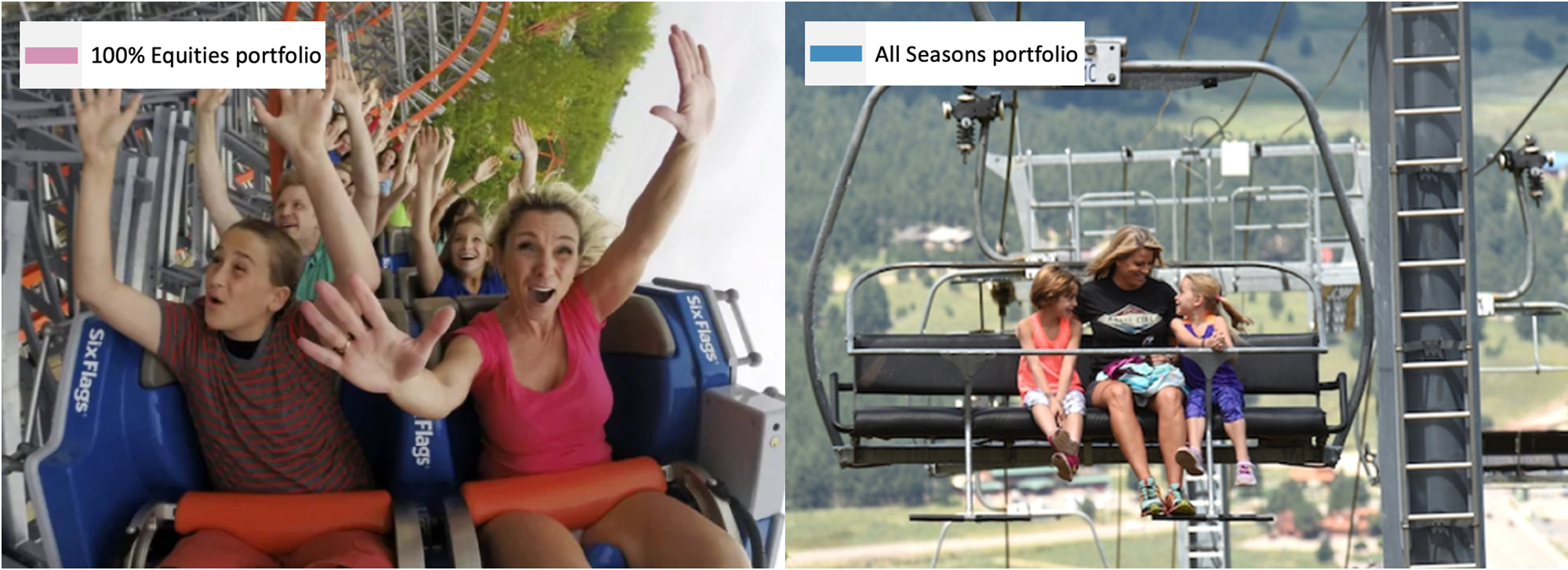

This joke from our original blog post has proved to be telling since we published it in Aug 2019!

This joke from our original blog post has proved to be telling since we published it in Aug 2019!